Most Virginians know that the law of the commonwealth provides for a certain order of inheritance for a person’s property if that person dies without a will. In legal parlance, dying without a will is known as dying “intestate” and the law dealing with what happens when someone dies intestate is known as the “intestacy law.”

For property that is not subject to any other controls on where it goes when the owner dies, Virginia’s intestacy law establishes an ordered list of people who will receive that property.

Real Property

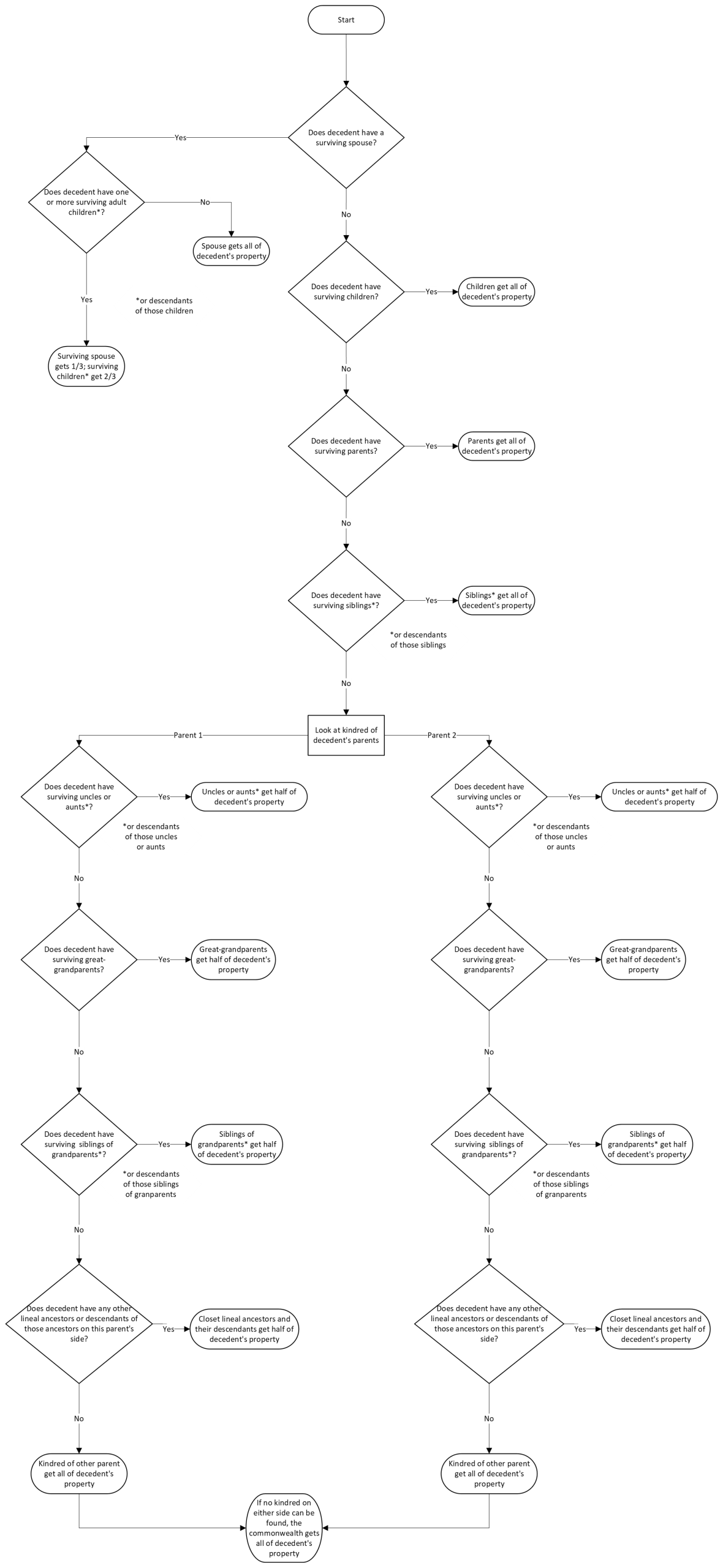

For real property (things like land and houses) the list is set up as a set of if-then scenarios:

- If a person dies (we call this person “the decedent”) but their spouse survives, then the spouse gets the property.

- But if the decedent has at least one surviving child (or a child’s descendants) who is an adult, the children get two thirds of the property, and the spouse gets the other third.

- If the decedent does not have a surviving spouse, the decedent’s children (or their descendants) get the property.

- If the decedent does not have a surviving spouse, children, or descendants of children, the decedent’s surviving parents get the property.

- If the decedent does not have anyone who fits into any of the above categories, the decedent’s surviving siblings and their descendants get the property.

- If the decedent does not have any surviving grandparents or any of the other people listed above, things get a bit more complex. Half the decedent’s property goes to the relatives of one of the decedent’s parents and the other half goes to the relatives of the other of the decedent’s parents, in the following order:

- First, to the surviving grandparents

- If there are no surviving grandparents, then to the decedent’s aunts and uncles and their descendants

- If there are none of the above, then to the decedent’s surviving great-grandparents

- If there are none of the above, then to the siblings of the decedent’s grandparents and their descendants

- The process goes on, tracing the decedent’s family tree, until the nearest lineal ancestors and their descendants are found, and once found, they get the property.

- If no living relative can be found to receive the half of the property set aside for the relatives of one of the decedent’s parents, all of the property goes to the other parent’s side.

If no relatives of any kind can be found, then the real property goes to the Commonwealth of Virginia, which deals with disposing of the property under a process known by the delightfully archaic term “escheatment.” See Title 55.1, Chapter 24 of the Code of Virginia for more details on that.

Personal Property

For personal property, which basically is all property that is not real property, the order in which different categories of relations to the decedent will receive the property is the same as for real property. The difference is that this personal property must first be used to pay funeral expenses, administrative charges, debts, and a statutory allowance to the decedent’s surviving spouse and minor children. If there is anything left over after these amounts are paid, that surplus gets distributed using the same if-then scenario set out for real property.

The following flowchart lays out the process for determining the order for who receives the decedent’s property:

Now, some folks may look at how the intestacy laws handle the distribution of a decedent’s estate and decide that the law automatically does what they want done with their property anyway. So, in in that situation, there’s no need for a will, right? Maybe, but there’s more to a will, and certainly more to an estate plan, than simply divvying up the testator’s property. A person’s will also can make clear who will take custody of surviving children if both parents have died–something not covered by Virginia’s intestacy succession laws.

These laws also can’t ensure that your wishes are honored regarding your medical care at the end of your life; you’ll need an advance medical directive for that. These laws likewise don’t give you the option to decide who will manage your affairs when you are no longer in a position to do so for yourself. You’ll need a power of attorney for that.

Doubtless there are many other end-of-life issues that a person might care about that the intestacy laws simply don’t cover. That’s why it makes sense for most people to have at least a basic estate plan in place, rather than passing on unnecessary uncertainty for those they leave behind. An estate planning attorney can help eliminate much of that uncertainty and replace it with peace of mind.

The Law Office of Levi Jones is here to answer your questions about wills and estate planning.